Financial giants have made a conspicuous bearish move on Chevron. Our analysis of options history for Chevron CVX revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $173,100, and 7 were calls, valued at $362,356.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $170.0 for Chevron over the last 3 months.

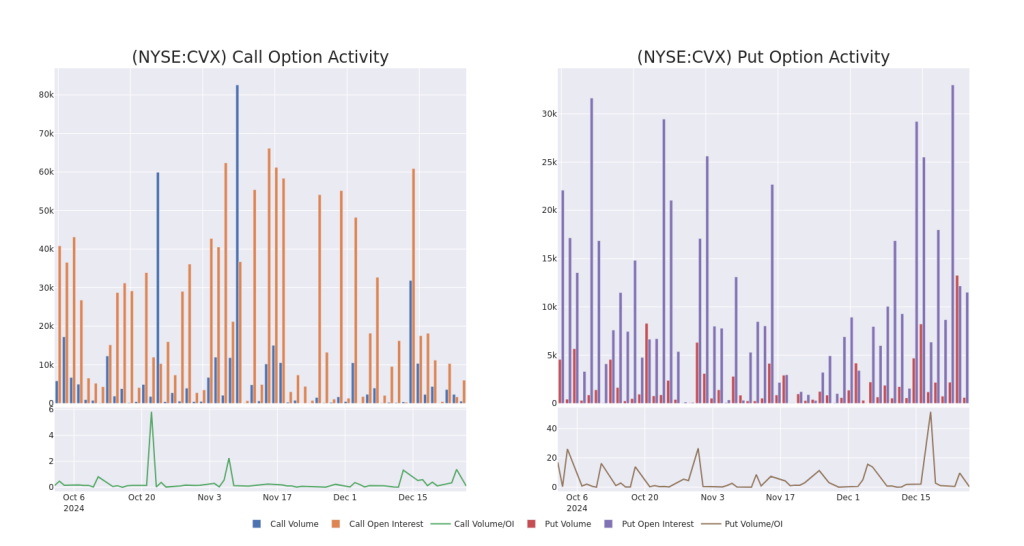

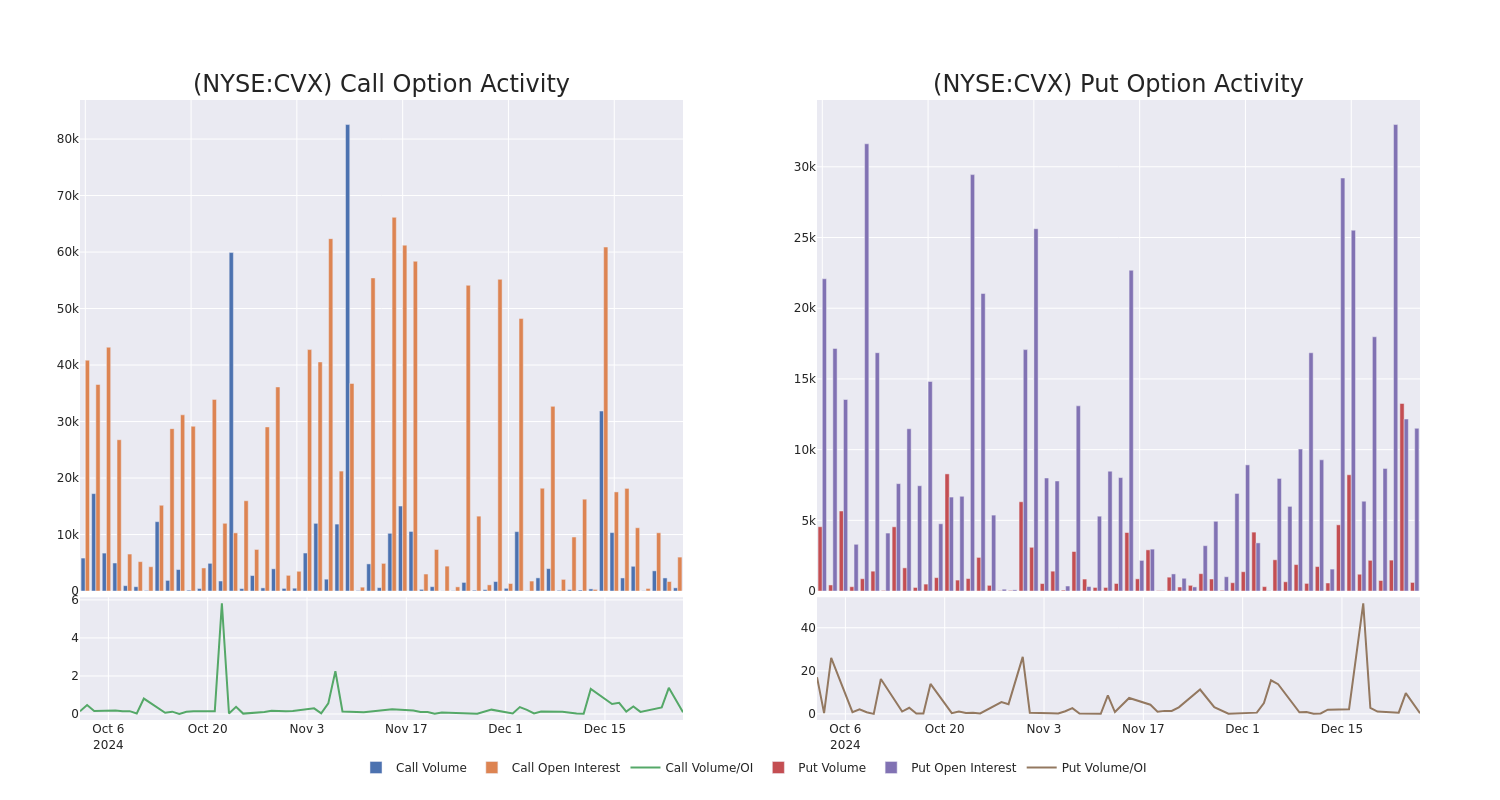

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Chevron’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chevron’s whale trades within a strike price range from $75.0 to $170.0 in the last 30 days.

Chevron Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | PUT | TRADE | BEARISH | 01/17/25 | $2.99 | $2.87 | $2.99 | $145.00 | $119.6K | 9.1K | 434 |

| CVX | CALL | SWEEP | BEARISH | 01/16/26 | $4.25 | $4.1 | $4.1 | $170.00 | $93.0K | 640 | 229 |

| CVX | CALL | SWEEP | NEUTRAL | 01/15/27 | $70.4 | $68.55 | $69.43 | $75.00 | $69.4K | 21 | 12 |

| CVX | CALL | TRADE | NEUTRAL | 09/19/25 | $45.4 | $44.05 | $44.64 | $100.00 | $53.5K | 20 | 12 |

| CVX | CALL | SWEEP | BEARISH | 02/21/25 | $15.6 | $15.4 | $15.4 | $130.00 | $47.7K | 8 | 45 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

In light of the recent options history for Chevron, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Chevron

- With a volume of 2,747,664, the price of CVX is down -0.21% at $143.54.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 36 days.

What The Experts Say On Chevron

In the last month, 4 experts released ratings on this stock with an average target price of $179.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Chevron, targeting a price of $188.

* An analyst from Truist Securities has decided to maintain their Hold rating on Chevron, which currently sits at a price target of $160.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Chevron, targeting a price of $195.

* An analyst from Piper Sandler has decided to maintain their Overweight rating on Chevron, which currently sits at a price target of $173.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chevron options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.