High-rolling investors have positioned themselves bullish on JD.com JD, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in JD often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for JD.com. This is not a typical pattern.

The sentiment among these major traders is split, with 44% bullish and 33% bearish. Among all the options we identified, there was one put, amounting to $33,200, and 8 calls, totaling $561,559.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $65.0 for JD.com during the past quarter.

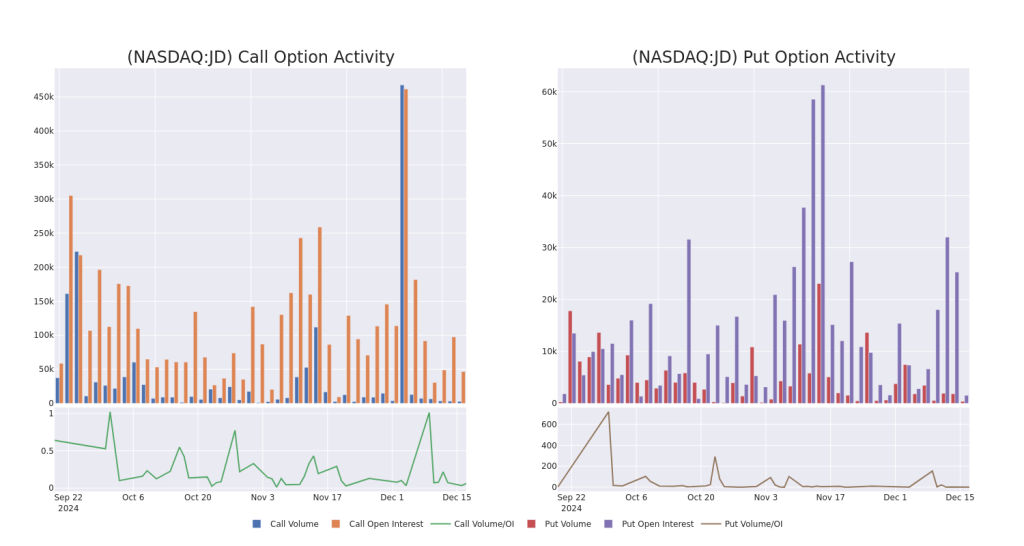

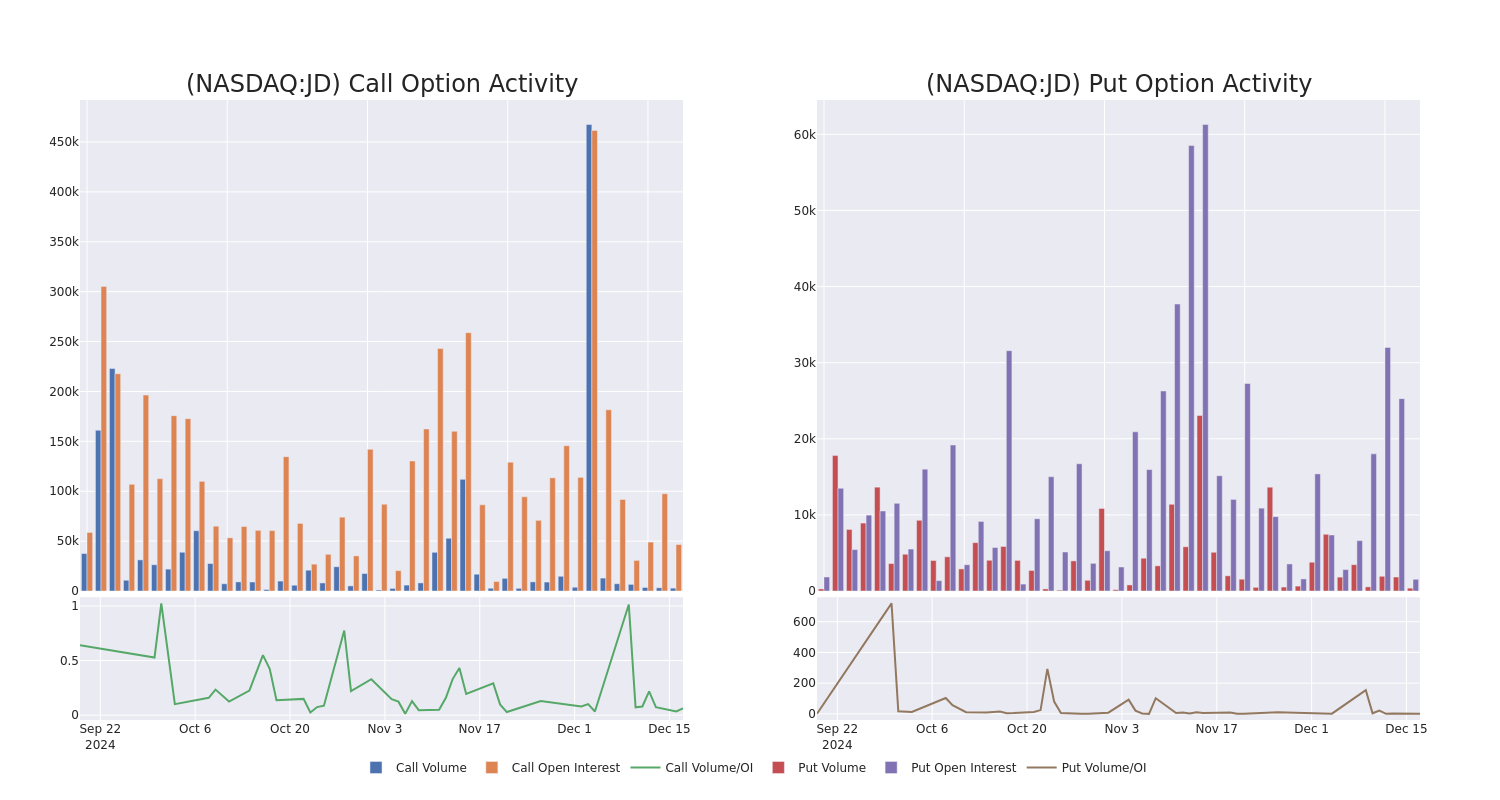

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $30.0 to $65.0 in the last 30 days.

JD.com 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | SWEEP | BULLISH | 01/15/27 | $3.9 | $3.65 | $3.9 | $65.00 | $195.0K | 64 | 501 |

| JD | CALL | SWEEP | BULLISH | 02/21/25 | $4.8 | $4.75 | $4.8 | $34.00 | $91.6K | 856 | 500 |

| JD | CALL | SWEEP | NEUTRAL | 01/03/25 | $7.55 | $7.45 | $7.5 | $30.00 | $75.0K | 6 | 603 |

| JD | CALL | SWEEP | BEARISH | 02/21/25 | $4.9 | $4.75 | $4.8 | $34.00 | $48.0K | 856 | 300 |

| JD | CALL | TRADE | BULLISH | 01/15/27 | $8.5 | $8.45 | $8.5 | $42.00 | $42.5K | 47 | 101 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Following our analysis of the options activities associated with JD.com, we pivot to a closer look at the company’s own performance.

Where Is JD.com Standing Right Now?

- With a trading volume of 3,402,746, the price of JD is up by 2.08%, reaching $37.48.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 78 days from now.

Expert Opinions on JD.com

1 market experts have recently issued ratings for this stock, with a consensus target price of $46.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Bernstein has elevated its stance to Outperform, setting a new price target at $46.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.