(Bloomberg) — China’s cancellation of tax relief on exports has left the aluminum industry scrambling to assess the impact on supply flows, with Chinese companies suffering steep stock declines while their international peers rally.

Most Read from Bloomberg

Beijing unveiled an overhaul of its export rebate regime late on Friday, announcing plans to remove a 13% tax rebate on overseas sales of aluminum, copper, and also cutting relief to batteries and solar panels.

Aluminum Corp. of China Ltd. and China Hongqiao Group Ltd., the country’s top two aluminum smelters, slumped as much a 5% in Shanghai and Hong Kong, before paring losses, while Yunnan Aluminum Co. hit its daily down limit of 10% in Shenzhen. Aluminum fell on the London Metal Exchange, paring a 5.3% gain seen on Friday.

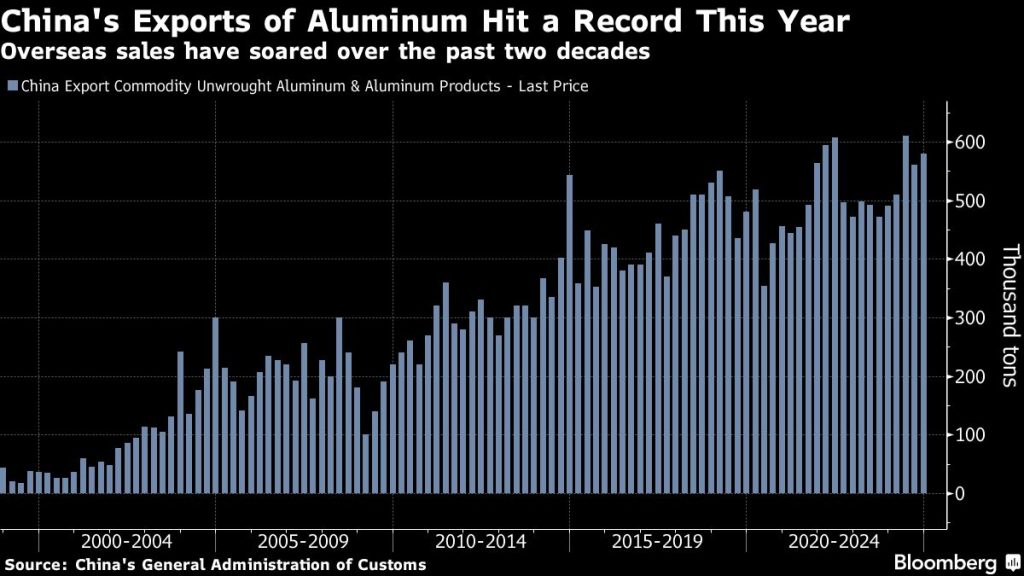

Beijing’s move — seen by some analysts as an attempt to ease China’s industrial overcapacity — triggered the biggest impact on aluminum among the affected commodities because of the importance of Chinese exports both to the country’s producers and global buyers. The tax changes comes into effect on Dec. 1

“This is one measure to tackle the long-standing low profitability of Chinese enterprises after investment-led stimulus fueled significant overcapacity,” said Li Xuezhi, head of Chaos Ternary Futures Co.’s research institute. “In the near term, it will hit exports. But in medium-to-long term, it will be beneficial as excess capacity will need to be cleared in some ways.”

China’s aluminum industry has historically exported significant amounts of the metal as semi-fabricated products — like rods, plates or foil — that are used by manufacturers or simply re-melted into other shapes.

The shipments of the metal used in everything from beer cans to automobiles have been a trigger point for trade battles with the US and Europe in the past, with smelters shuttering across the globe due to excess supply, low prices and high energy costs.

The tax tweak comes ahead of President-elect Donald Trump’s return to the White House with a vow to ramp up tariffs to defend American industry. It was also unveiled as President Xi Jinping met US President Joe Biden in Peru, emphasizing China’s desire for cooperation between the word’s top two economies.

“This could be a strategic power move, demonstrating China’s crucial role in global markets and its ability to influence prices and demand,” ING commodities strategists Ewa Manthey and Warren Patterson said in an emailed note. “In the near term, the cancellation of rebates will make Chinese aluminium more expensive on the international market and could lead to a reduction in export volumes.”