(Bloomberg) — Alibaba Group Holding Ltd. reported anemic growth in its core Chinese e-commerce business in the September quarter, dragging down financial results that benefited from progress in its international and cloud divisions.

Most Read from Bloomberg

Overall sales rose about 5% after the internet pioneer’s domestic e-commerce operation eked out just 1% growth, slightly weaker than analysts anticipated. The international division, which encompasses Lazada and the Temu-like AliExpress, expanded retail revenue 35% — again outshining all other segments. The cloud unit’s revenue growth accelerated to more than 7%, suggesting it’s beginning to claw back market share lost to state rivals.

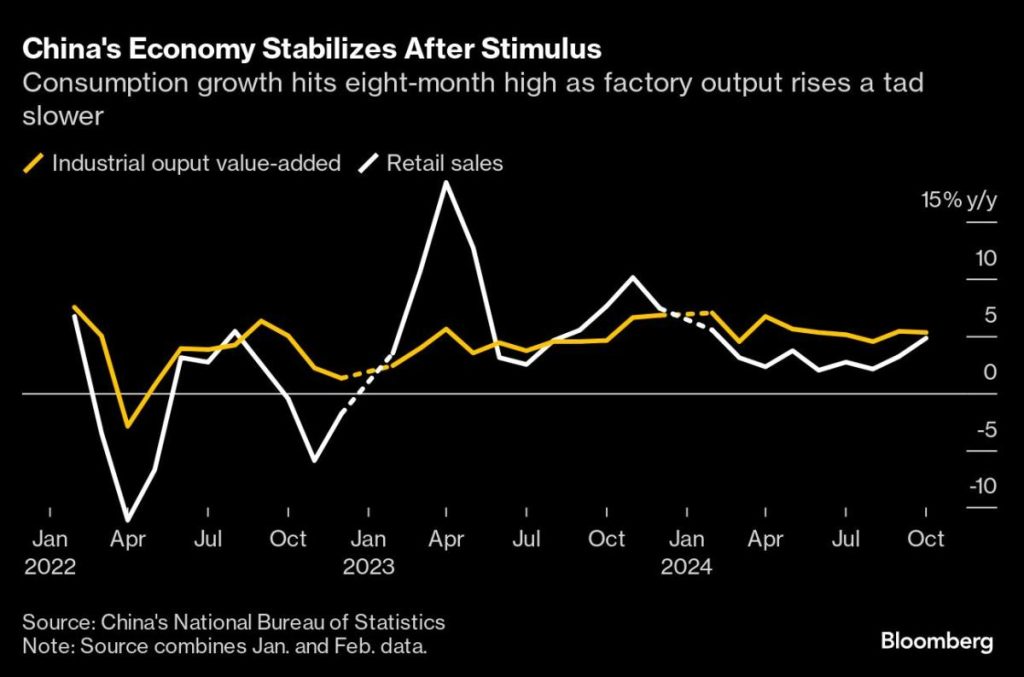

Alibaba’s shares fell as much as 3.7% in New York trading. The company is reporting hours after the latest Chinese economic data showed encouraging signs for the world’s second largest economy. Retail sales grew at their strongest pace in eight months.

Still, the company that once dominated online commerce across the country is struggling to regain its footing after a bruising government-led antitrust investigation that limited its expansion opportunities and bolstered rivals like PDD Holdings Inc. Chief Executive Officer Eddie Wu is more than a year into his effort to turn around the company.

Alibaba ADRs Advance on 2Q Profit Beat: Street Wrap

Wu on Friday expressed hope that Beijing will unleash more stimulus measures to revitalize consumers, echoing comments from his counterparts at Tencent Holdings Ltd. and JD.com Inc. this week. But like the others, he too stopped short of making a call on when a rebound will emerge.

“We are optimistic about the government’s macro stimulus policies and are confident in their positive long-term economic impact,” Wu told analysts on a conference call.

In August, regulators said Alibaba has ceased all monopolistic acts as they wrapped up a three-year rectification period for the company.

Its revenue climbed to 236.5 billion yuan ($32.7 billion) in the September quarter, versus an average estimate for 239.4 billion yuan. Net income rose 58% to 43.9 billion yuan, though a big part of that came from gains in investments.

“We are more confident in our core businesses than ever and will continue to invest in supporting long-term growth,” Wu said.

Alibaba’s domestic commerce business shrank for the first time in at least a year during the June quarter, driving home the malaise plaguing the country and its leading online retailer. Taobao and Tmall — Alibaba’s signature e-commerce services — have since September begun to charge merchants a software service fee that’s common on rival platforms like PDD and JD.com.