(Bloomberg) — Emerging-market assets extended gains after the Federal Reserve cut its benchmark interest rate by a quarter percentage point, a move that was widely expected by markets as the monetary authority moves to support the world’s largest economy.

Most Read from Bloomberg

MSCI’s index for emerging currencies rose 0.4%, with the Colombian peso and the Hungarian forint among the biggest gainers. A gauge tracking developing world stocks rallied further after the rate decision, trading 1% higher.

The dollar, meanwhile, extended its losses following its best day since 2022 after Donald Trump’s election victory. Treasury yields fell.

The US central bank lowered the federal funds rate to a range of 4.5% to 4.75%. The adjustment follows a half-point cut in September. Policymakers removed a line about having “greater confidence” that inflation is moving sustainably toward 2%, though they noted inflation has “made progress” toward the central bank’s goal.

In his usual post-rate decision press conference, Fed Chair Jerome Powell said US economy remains strong, while he refrained from signaling the Federal Reserve will skip cutting rates in December.

“Powell expressed a lot of confidence in the economy and in current monetary policy,” said Brad Bechtel, global head of FX at Jefferies LLC. “He indicated that it is far too early to input any new policies from the new administration into their forecast models, so no read through from the election. A very middle of the road rate decision that is unlikely to have any major impact on markets near term.”

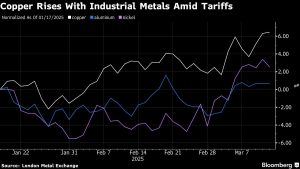

Mexico’s currency, which is sensitive to US economic and political risks given the country’s close trade links, also held onto gains, rising 1.3% against the dollar. Latin American currencies were among the biggest gainers given their carry-trade appeal, while also getting a boost from rising commodity prices.

The Colombian peso rose as much as 2.3%. The Brazilian real gained briefly, but then resumed its losses, falling 0.3% against the greenback.

“Latam is still associated with the strongest carry appeal,” said Brendan McKenna, a strategist at Wells Fargo & Co. in New York. “These currencies have been beaten up a little bit recently, so entry points and a combination for carry makes them a bit more attractive.”

Equities across emerging markets rallied further, rising 1%. The index is boosted by gains in Asian stocks like Meituan, Tencent Holdings and Taiwan Semiconductor Manufacturing Co. Optimism that China could deploy a larger fiscal stimulus in light of a new Trump administration is also boosting emerging-market assets.