Kimberly-Clark KMB is preparing to release its quarterly earnings on Tuesday, 2024-10-22. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Kimberly-Clark to report an earnings per share (EPS) of $1.70.

The announcement from Kimberly-Clark is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

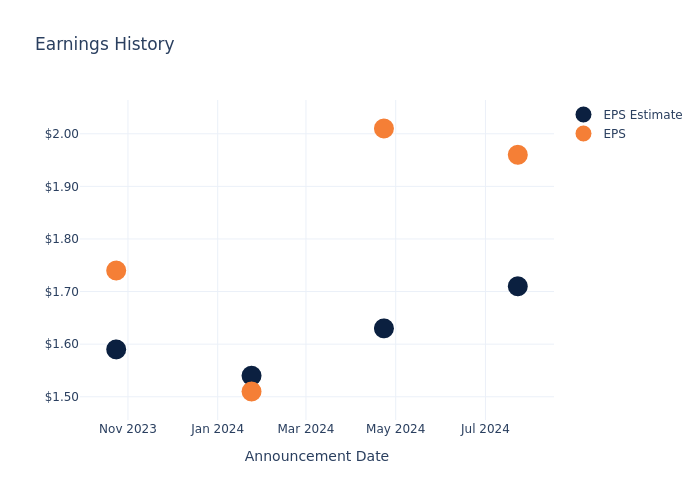

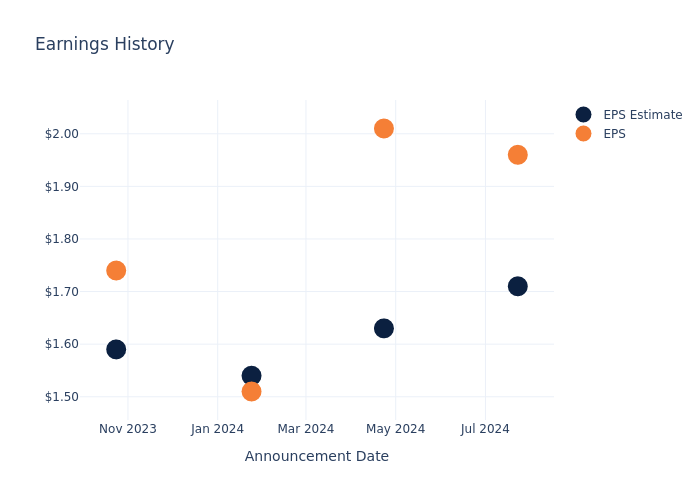

Historical Earnings Performance

The company’s EPS beat by $0.25 in the last quarter, leading to a 3.41% increase in the share price on the following day.

Here’s a look at Kimberly-Clark’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.71 | 1.63 | 1.54 | 1.59 |

| EPS Actual | 1.96 | 2.01 | 1.51 | 1.74 |

| Price Change % | 3.0% | 1.0% | 2.0% | -1.0% |

Tracking Kimberly-Clark’s Stock Performance

Shares of Kimberly-Clark were trading at $145.41 as of October 18. Over the last 52-week period, shares are up 19.84%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Kimberly-Clark

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Kimberly-Clark.

The consensus rating for Kimberly-Clark is Neutral, based on 7 analyst ratings. With an average one-year price target of $147.86, there’s a potential 1.68% upside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of Church & Dwight Co, Clorox and Colgate-Palmolive, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Church & Dwight Co received a Underperform consensus from analysts, with an average 1-year price target of $103.58, implying a potential 28.77% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Clorox, with an average 1-year price target of $152.42, implying a potential 4.82% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Colgate-Palmolive, with an average 1-year price target of $108.58, implying a potential 25.33% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Church & Dwight Co, Clorox and Colgate-Palmolive, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Kimberly-Clark | Neutral | -2.05% | $1.81B | 49.91% |

| Church & Dwight Co | Underperform | 3.92% | $712.10M | 5.79% |

| Clorox | Neutral | -5.75% | $884M | 103.10% |

| Colgate-Palmolive | Buy | 4.89% | $3.07B | 414.16% |

Key Takeaway:

Kimberly-Clark ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, Kimberly-Clark is at the top.

Discovering Kimberly-Clark: A Closer Look

With more than half of sales from personal care and another third from consumer tissue products, Kimberly-Clark sits as a leading manufacturer in the tissue and hygiene realm. Its brand mix includes Huggies, PullUps, Kotex, Depend, Kleenex, and Cottonelle. The firm also operates K-C Professional, which partners with businesses to provide safety and sanitary offerings for the workplace. Kimberly-Clark generates just over of half its sales in North America and more than 10% in Europe, with the rest primarily concentrated in Asia and Latin America.

Financial Insights: Kimberly-Clark

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Kimberly-Clark faced challenges, resulting in a decline of approximately -2.05% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Kimberly-Clark’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 10.82% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Kimberly-Clark’s ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 49.91%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Kimberly-Clark’s ROA stands out, surpassing industry averages. With an impressive ROA of 3.17%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Kimberly-Clark’s debt-to-equity ratio is below the industry average. With a ratio of 7.01, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Kimberly-Clark visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.